Flashback November 2005: NAR States "Foreclosure Risk Minimal"

A rather unfortunate incident turned into a source of entertainment for me today…

The unfortunate incident was that my old desktop computer, which I set up in 2006 and used pretty much every day since, finally gave up the ghost. Therefore, I spent most of this weekend setting up a new desktop system (a Shuttle SX38P2 Pro with an Intel E8400 processor overclocked to 3.4GHz/1600MHz FSB, if you’re curious.)

While setting up my new desktop, I decided it was probably time to “clean house” a bit and go through all my old documents. I spent a few hours weeding out over 50GB (!) of no-longer-needed files. While digging through archives of documents I had saved, I came across a gem: A PDF report from the National Association of Realtors, which is dated November 28, 2005.

I now vaguely remember chuckling at this report in 2005 when I saved it, knowing I would probably want to keep it for posterity. I have saved it in all of its glory here on my server for your reference. As you read it, I assure you at least some of you may think this is fake or exaggerated. Fortunately for both of us, some not-so-astute Realtors(TM) made a copy freely available on their site as well. (I note that they have removed “Fremont” from the title of their copy of the PDF…likely because their office does not serve the Fremont area.)

Let’s kick back, pop open a cold drink, and have a look!

NAR Decries: No Bust In Sight!

A quick refresher — 2005 was the year housing prices peaked in the Bay Area. There were no signs of a slowdown in sight. The NAR made this quite clear:

“With home prices rising strongly in most parts of the country, there has been widespread media coverage on the possibility of a housing market bust. A thorough analysis of the San Francisco-Oakland-Fremont metro market, as detailed below, reveals that there is little danger of this.”

Shew! Sure glad I trusted the NAR. *wipes sweat from brow*

Next paragraph:

“Because prices have risen faster than income, the ratio of price-to-income is currently above the historical norm. This measure is frequently cited to imply that there is a housing market bubble. But this ratio is a misleading measure in assessing bubble prospects. A more relevant measure is the mortgage servicing cost relative to income. This ratio is at a very manageable level. It implies no widespread financial overstretching to purchase a home in the region.” (emphasis mine)

I am sure all of the people whose homes are now in foreclosure found this very comforting.

“Affordability”

“The current price of $726,900 is more than three times the national average.”

Let me emphasize that this was the median price… i.e. half of all houses sold for more than $726,900. This in an area where the median household income is just over $70,000 a year! How can the “median” family have afforded a house that was 10x their annual income? The answer is… they couldn’t, and so they resorted to “liar loans” and interest-only loans in a sucker’s game that would leave everyone involved worse off than before.

“Job Creation” Touted Is Actually Nonexistent

Of all of the crap in this PDF, there are two things about it that really do bother me. The rest I can shrug off or laugh at, but these two are artful manipulation. Here’s the first one:

“The job market has turned the corner after taking a large hit from the fallout of the technology bubble. There have been 24,100 payroll job additions in the past 12 months to July. Many new job holders seek their own housing units.”

STOP RIGHT THERE. Contrast the above statement with the following article, which appeared in the San Francisco Chronicle in September 2005 — just two months prior to this bubblicious PDF:

“The Berkeley labor economists noted that the state’s economy has gotten a huge boost from housing. Construction and related fields such as real estate or lending, all related to the housing boom, accounted for half of all the net job growth in the state between 2002 and 2005.”

HALF. HALF of all job growth since the bust in the so-called “Silicon Valley” was NOT in tech, but in real estate.

Are you beginning to see what a monster this housing boom/bust has created? We are nowhere near the bottom. Those real estate jobs that were created arguably won’t be needed in a bust, just like the many dot-com boom jobs that were created vanished within 3 years after the bust.

This is only the beginning of the shakeout. It has been only about two years since the party stopped. It will be several more before we can realistically say what an impact it will have when most of the jobs that were created during the “recovery” disappear…again.

NAR Acknowledges the Dark Horse

This is the other piece that shook me so visibly. NAR and others have been quiet about how many houses were financed with dangerous “ticking time bomb” loans. But in this document, it’s clearly spelled out:

“ARMS accounted for 67% in 2004 across the region, one of the highest rates in the country. Furthermore, the interest-only loans accounted for nearly half of all loans in 2004.”

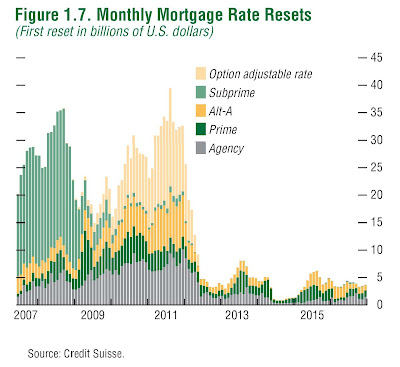

ARMs are Adjustable Rate Mortgages, or mortgages that “float” with the interest rate. Many of them have “introductory rates” at 1, 2, or 3% and then reset higher — much higher — after a period of 3-5 years.

Here is a chart (not from the NAR, of course) that shows when the ARMs will reset:

(Click on image for bigger image)

We are not even a year into this chart. The worst is yet to come. 67% of the loans taken out were adjustable rate. The recent interest rate lowering by the Fed may help folks with these loans out, and surely some of them will refinance…but banks won’t refinance loans that are “underwater” — where the borrower owes more than his/her home is worth. As prices decline, more and more of these homes go underwater.

In Conclusion: Pay Attention!

Pandering and bad statistics being touted as “news” showcases a major problem I have with newspapers and news sources in general: often, in an effort to be “balanced”, they will place a quote from a NAR representative or a local real estate agent next to a quote from an economist. The problem is that one group (real estate agents) makes money when you buy a house, so of course they will always urge people to buy. The other side — economists — have no vested interest in what the market does, because they get paid to write reports no matter what happens.

Whenever you read news articles, be careful to pick out why someone is saying what they are saying. If their job depends on you taking a specific action (like buy a house), they will make sure their slant is that you should do it, even if it is clearly not in your best interest. Take anything anyone with financial vested interest in you taking an action says with a grain of salt.

Always keep abreast of alternate sources like Patrick.net and the Housing Bubble Blog for non-Realtor-biased news.

My next real estate post will be next week, and it will be your complete guide to figuring out exactly when the higher-priced houses will begin to fall in price (I have charts!) and unbiased numbers that show you how to decide when a coastal property or a higher-priced property is considered “affordable”. It’s something that many of you have requested — and that I have a personal interest in, as I do expect to eventually buy an ocean-view property. Of course, I am not a real estate agent, and I won’t make any money whether you decide to buy a property or not… I just enjoy researching and writing about economics and real estate.

Make sure to subscribe to my blog — I post about the real estate market at least once a month. As always, if you have questions or comments, I welcome them in the comments below — and I do try to answer them all.